Before You Sign Your Mortgage Renewal – Watch This

Most homeowners renew without reviewing options. A 15-minute conversation with Cam Wilson could save you thousands.

Cam Wilson provides Strategic Mortgage Planning for Niagara Homeowners

You’re not hiring someone to “find you a rate.”

You’re structuring one of the largest financial decisions of your life.

As a Top 5% Mortgage Professional in Canada, I help clients across Greater Niagara and Ontario properly structure their mortgages.

Mortgage Services

Renewing in 2026? Don’t Sign Before You Review.

Nearly 40% of Canadian mortgage holders are renewing in 2026 — the largest wave in recorded history.

Your bank will send you a renewal letter.

It looks simple.

But your renewal is your biggest leverage moment.

Before you sign, let’s review:

![]() Payment shock protection

Payment shock protection

![]() Restructuring opportunities

Restructuring opportunities

![]() Debt consolidation options

Debt consolidation options

![]() Amortization adjustments

Amortization adjustments

![]() Better lending solutions

Better lending solutions

Schedule Your Mortgage:

SCHEDULE A FREE MORTGAGE CONSULTATION

COMPLETE SECURED ON-LINE APPLICATION

Cam Wilson In the News & Community Financial Leadership

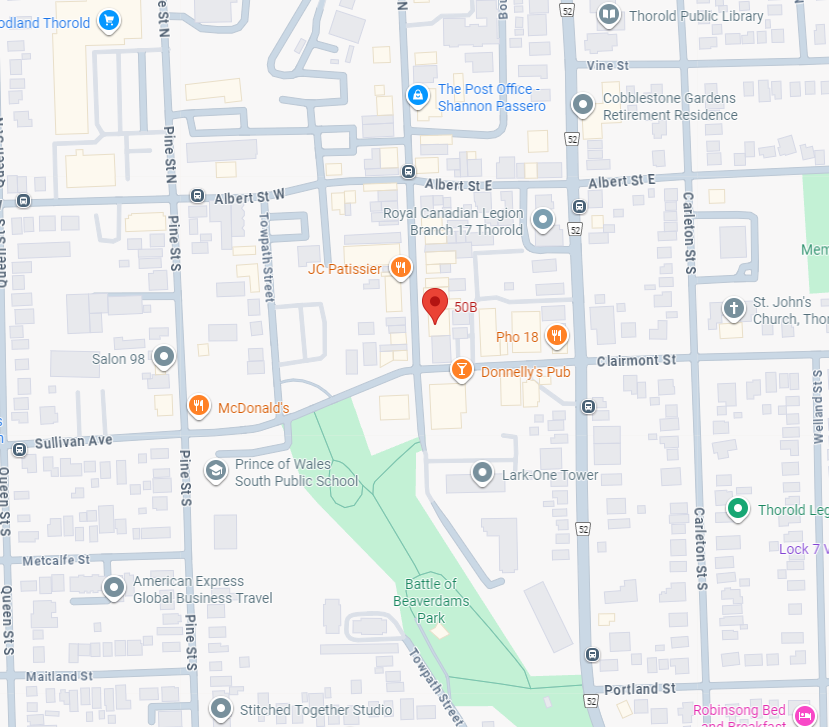

Serving Niagara From Multiple Locations

Serving Niagara & Southern Ontario

St. Catharines | Thorold | Niagara Falls | Welland | Port Colborne | Fort Erie

Pelham | Grimsby | West Lincoln | Niagara-on-the-Lake | Lincoln | Wainfleet

Dunnville | Burlington | Hamilton | Mississauga | Oakville | Toronto

Interested In Getting Mortgage Advice?

Send Us A Message

"*" indicates required fields

Resources

Where do I begin to express my gratitude for Cam. We weren’t sure if we would even get approved for a mortgage. Cam met with us in person went over all our info. He got us approved for a mortgage and even got us an incredible interest rate. We got to house hunting right away and found our dream home. We now get to renovate and build a brand new fence and call this house a home. Thank you Cam for all your help. I’m a homeowner thanks to you!!!

Meaghan Mulcair

Lowest IRD Mortgage Penalties in Canada

Breaking your mortgage before the end of its term can cost thousands in penalties. Many Canadians face this situation when life changes unexpectedly — moving and renting, refinancing, divorce, job loss, illness, taking advantage of lower rates, pursuing an investment opportunity, or other urgent needs.

Contact Us

Interested In Meeting Up?

Send Us A Message

"*" indicates required fields